Home of Top Gun Real Estate Investors

Special Invitation and Gift to You for an

Incredible Opportunity That Could

Transform Your Financial Future

**Flight and Hotel Included**

Home of Top Gun Real Estate Investors

Special Invitation and Gift to You for an

Incredible Opportunity That Could

Transform Your Financial Future

**Flight and Hotel Included**

Home of Top Gun Real Estate Investors

Special Invitation and Gift to You for an

Incredible Opportunity That Could

Transform Your Financial Future

Home of Top Gun Real Estate Investors

Special Invitation and Gift to You for an Incredible Opportunity That Could Transform Your Financial Future

Home of Top Gun Real Estate Investors

Special Invitation and Gift to You for an

Incredible Opportunity That Could

Transform Your Financial Future

**Flight and Hotel Included**

Get your free copy of The Epic Seller Finance Contract

Increase your seller conversions with this shortcut.

Get your free copy of The Epic Seller Finance Contract

Increase your seller conversions with this shortcut.

Epic Real Estate, led by Matt Theriault, is a community and set of tools and resources for real estate investors. If you want to build a steady stream of passive income by investing in real estate, then Epic Real Estate is designed specifically for you.

Epic Real Estate, led by Matt Theriault, is a community and set of tools and resources for real estate investors. If you want to build a steady stream of passive income by investing in real estate, then Epic Real Estate is designed specifically for you.

MISSION

Our mission is to help people become financially free without sacrificing everything else in their life.

METHOD

We are aware that the majority of people lead lives marked by sacrifice and betrayal. So, in order to prevent people and their families from experiencing a lifetime of financial stress, we have developed a system that gives people the chance to make their money work harder for them than they did for it.

MINDSET

We believe that discipline equals freedom. We are a community who are not afraid to put in the effort, do the repetitions, and turn up to the big show, creating epic, life-changing, legacy wealth.

REI Ace

Special invitation and gift to you for an incredible opportunity that could transform your financial future.

The Epic REI Ace System™ Philosophy is Simple

Attract

Convert

Exit

Accelerate Your Path to Financial Freedom with The Epic REI Ace System™: The Ultimate Game-Changer for Passive Income through Real Estate. When you master the art of ATTRACTING lucrative real estate opportunities, CONVERTING those opportunities into successful investments, and EXITING results at scale, you will possess the essential tools to swiftly expand your real estate investment portfolio into the thriving passive income game that you envision and rightfully deserve. All our resources are tailored to assist you in excelling at these three crucial components, incorporating state-of-the-art proprietary strategies and tools.

Here at Epic Real Estate, we work hard so you don't have to.

Accelerate Your Path to Financial Freedom with The Epic REI Ace System™: The Ultimate Game-Changer for Passive Income through Real Estate. When you master the art of ATTRACTING lucrative real estate opportunities, CONVERTING those opportunities into successful investments, and EXITING results at scale, you will possess the essential tools to swiftly expand your real estate investment portfolio into the thriving passive income game that you envision and rightfully deserve. All our resources are tailored to assist you in excelling at these three crucial components, incorporating state-of-the-art proprietary strategies and tools.

Here at Epic Real Estate, we work hard so you don't have to.

Unlocking the Secret Formula for Success

No Compromise, Just Maximize.

Because It’s Time To Seek Real Estate Investment Advice From Experts

100%

Satisfaction Guaranteed

+375M

Invested in Real Estate

3.5K

Deals Financed

4.1K

Deals Closed

Here’s the “real deal” in just three sentences: Only you can stop you. The Epic community is stocked with all the tools and resources to go from “cloud-like dreams that slowly fade away” to “rock-solid buildings that bring you profits every day”.

Elevate Your Financial Game Now

Supercharge Your Portfolio! Seize control and ownership by becoming a passive investor in real estate –No landlord headaches or house-flipping stress.

Hear What Our Epic Fans Are Saying

Phillip Mutulo

"I wanted to make sure my first purchase was going to be a solid investment and I knew help would be needed. The support I received during the process was outstanding! They held my hand every step of the way and I guided me through the entire process. I was blown away with my experience and have referred my friends as a result."

Jennifer Omhari

"I honestly couldn't have bought my property without Mercedes and the CashFlow Savvy Team. They literally held this newbie’s hand throughout the entire process and believe me, I needed a lot of hand holding. If it wasn't for them, I would still be wishing I was a real estate investor right now instead of actually being a real estate investor. How do you thank someone in words for all of that? It's just not possible. Nothing seems adequate."

Nate Hammond

"I found CashFlow Savvy after listening to Matt's Turnkey Real Estate Investing Podcast on iTunes. At the time I was in the market for a turnkey provider for my first property. After my consultation call with Mercedes, I felt confident that CashFlow Savvy was the right choice for me! Right away Mercedes started sending me available turnkey properties. Once I found the right one for me the CashFlow Savvy essentially took care of the rest! Throughout the process, the CashFlow Savvy team was both responsive and proactive in answering all my questions and guiding me through the process of buying my first investment property."

Ray Rosato

"I met the CashFlow Savvy team at a property tour and instantly knew they were the right choice for me. I found Mercedes and the team to be very accessible, experienced, and relationship-oriented. They are very selective in qualifying properties and look out for your interest. They also provide great contacts and tips which helped facilitate a smooth transaction during this first purchase."

Lori and Carlos

"Working with Mercedes and the team at CashFlow Savvy was a breeze. We're on our way to becoming financially free and I wish we had done this sooner!"

Enrique & Irem Santana

"From our first conversation to our latest transaction, Mercedes and the team she’s connected us with have been extremely helpful and essential toward making our financial goals a reality. At the beginning of the year, we had a savings account with a nice pile of cash doing nothing for us and no investment properties. Today we don’t have much in our savings but have 6 cash flowing rentals which cover over 1/3 of our expenses. It’s nice to have a team that can answer any questions we may have and is ready with quality cash flowing investment properties every time we are ready for one."

Lanita Holland

"Being able to work with a company that has experience with their own personal investments as well as experience with helping others find investments for themselves has been very valuable. The team at CashFlow Savvy, as well as the teams they have in the cities they work in, were patient, helpful and always willing to share their knowledge when I needed it.

To date I have purchased 2 properties with CashFlow Savvy and I plan on purchasing many more in the future. They make the process as easy as possible. The hardest part was raising the capital! Thank you for giving me a truly Turn Key experience."

Seth Leiboh

"I can't believe acquiring my first rental was so easy!"

"After working a year in real estate development I thought that there has to be a faster way to build a portfolio, and that's when I discovered Epic.

In my first 90 days, I've quit my day job and added 7 income properties to my passive income portfolio. Thanks so much Matt!"

Christina Lopez

"I needed freedom. I had to do this. In my first 6 months, I closed multiple wholesale deals and flips.

On my first wholesale deal, I made $25K, and on my first flip I made $55K. I now have the freedom to do what I want, but more importantly the freedom from what I DON'T want."

Gabe Stockton

"I sent a bunch of handwritten yellow letters to owners of vacant houses. I'm getting 20-30 calls a day right now from that one mailing.

I've already closed one deal for $18,500 of profit & I'm really close to closing more. It really is possible to make money when you have no money."

Devin Romberger

"After working a year in real estate development I thought that there has to be a faster way to build a portfolio, and that's when I discovered Epic.

In my first 90 days, I've quit my day job and added 7 income properties to my passive income portfolio. Thanks so much Matt!"

Christina Lopez

"I needed freedom. I had to do this. In my first 6 months, I closed multiple wholesale deals and flips.

On my first wholesale deal, I made $25K, and on my first flip I made $55K. I now have the freedom to do what I want, but more importantly the freedom from what I DON'T want."

Gabe Stockton

"I sent a bunch of handwritten yellow letters to owners of vacant houses. I'm getting 20-30 calls a day right now from that one mailing.

I've already closed one deal for $18,500 of profit & I'm really close to closing more. It really is possible to make money when you have no money."

Devin Romberger

"Just by listening to Matt's podcast and joining REI Ace, I have added nearly a million dollars in actual value to my real estate net worth."

Steve Adkins

"In my first year mentoring with Matt, I added $3,200 per month to my passive income & increased my net worth by $500,000."

Ryan Miersma

"I closed 4 wholesale deals and paid off my REI Ace education & had some money left over to fund my first fix n' flip where I made $300,000."

Chevy Ala

"Just by listening to Matt's podcast and joining REI Ace, I have added nearly a million dollars in actual value to my real estate net worth."

Steve Adkins

"In my first year mentoring with Matt, I added $3,200 per month to my passive income & increased my net worth by $500,000."

Ryan Miersma

"I closed 4 wholesale deals and paid off my REI Ace education and had some money left over to fund my first fix n' flip where I made $300,000."

Chevy Ala

"I have direct access to Matt and his team. There's always someone available to answer my questions. It really ramps up the learning process for me."

Willie Booker

"In our first year working with Epic we made $1,700,000 in equity & flipping profits. We quit our day jobs and now our former boss works for us."

Tony Romeo & Matt Young

"One of my favorite things about working with Epic is that

I've been successful with them."

Marie Everett

"I have direct access to Matt and his team. There's always someone available to answer my questions. It really ramps up the learning process for me."

Willie Booker

"In our first year working with Epic we made $1,700,000 in equity & flipping profits. We quit our day jobs and now our former boss works for us."

Tony Romeo & Matt Young

"One of my favorite things about working with Epic is that

I've been successful with them."

Marie Everett

Daniel Akkerman was a U.S. army ranger & sniper who returned from overseas protecting our country with a goal to seek more for himself both in life & as an entrepreneur.

Just 3 months after joining REI Ace, Daniel closed 14 wholesale deals & added 7 cash-flowing rental properties to his portfolio. He shared his experience at the Epic Intensive

Daniel Akkerman

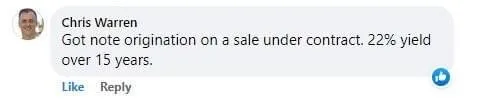

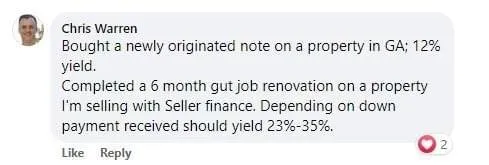

When Chris Warren left his 13 year job as a project manager, he was on the look-out for an accelerator to boost his real estate business as quickly as possible.

Chris stepped up to the real estate & joined the REI Ace Program.

He is now consistently closing deals & has deemed himself financially free.

Chris Warren

Tony Jardieu was planning on retiring from his long career in banking when he discovered Matt’s podcast & was hooked.

Tony and his wife, Cyndee joined forces & came to the Epic Intensive with a goal & left with a plan. Upon becoming REI Ace members, their plan was to escape the rat race.

13 months later, Tony & Cyndee added more than 30 cash flowing assets to their portfolio by applying the strategies & systems in REI Ace.

Tony & Cyndee

Daniel Akkerman

was a U.S. army ranger & sniper who returned from overseas protecting our country with a goal to seek more for himself both in life & as an entrepreneur.

Just 3 months after joining REI Ace, Daniel closed

14 wholesale deals & added 7 cash-flowing rental properties to his portfolio. He shared his experience at the Epic Intensive

Daniel Akkerman

When Chris Warren

left his 13 year job as a project manager, he was on the look-out for an accelerator to boost his real estate business as quickly as possible.

Chris stepped up to the real estate & joined the REI Ace Program.

He is now consistently closing deals & has deemed himself financially free.

Chris Warren

Tony Jardieu was planning on retiring from his long career in banking when he discovered Matt’s podcast & was hooked.

Tony and his wife, Cyndee joined forces & came to the Epic Intensive with a goal & left with a plan. Upon becoming REI Ace members, their plan was to escape the rat race.

13 months later, Tony & Cyndee added more than 30 cash flowing assets to their portfolio by applying the strategies & systems in REI Ace.

Tony & Cyndee

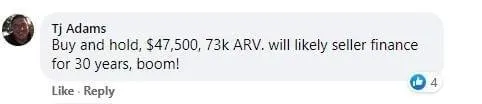

"Should be able to pull $20k of equity out for future investments!"

"2 properties under contract for rent to own lease option"

"Closed $1.2M sale"

"Took a $37k wholesale fee"

"Sold 2 properties. $10k net one, $38k net on the other."

"22% yield over 15 years."

"Bought a property in Georgia; 12% yield"

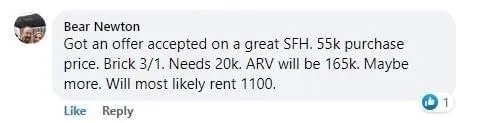

"Got an offer accepted - $55k purchase price. ARV will be $165k."

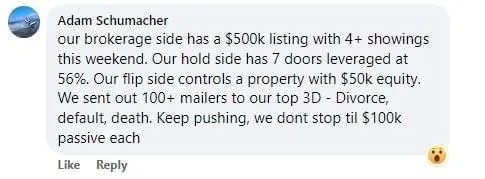

"Our hold side has 7 doors leveraged at 56%. Our flip side controls a property with $50k equity."

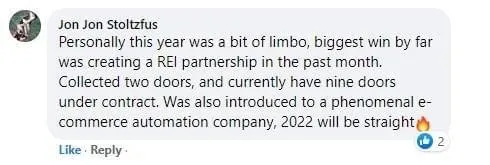

"Biggest win was creating an REI partnership. Collected 2 doors & currently have 9 doors under contract"

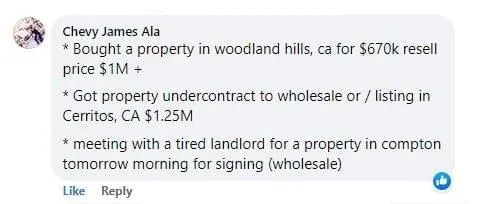

"Bought a property in Woodland Hills, CA for $670k, resell price $1M+ "

"Closed on my 2nd flip sale today, hired a VA, got another house under contract"

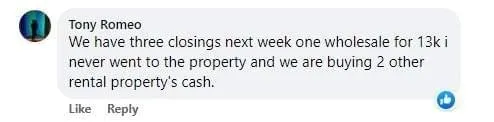

"We have 3 closings next week, one wholesale for 13k. "

"Closed on the purchase of a bed and breakfast!"

"Two more cash flow properties under contract!"

"Closed on 9 rentals last week, 2 more next week!"

"Getting 5 units under contract after the holiday"

"Sold a SFH for $60k profit. Bought two for fix and flip."

"Seller finance contract. Principal-only payments, on a fourplex!"

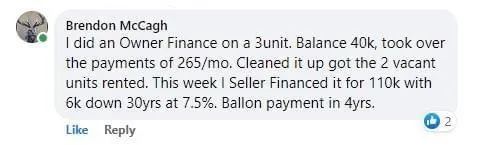

"I did an Owner Finance on a 3-unit. Balance 40k, took over the payments of $265/mo. Cleaned it up, got the 2 vacant units rented. "

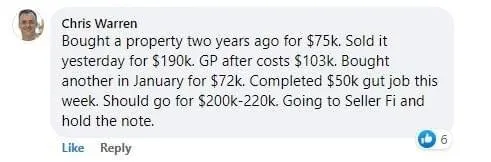

"Bought a property two years ago for $75k. Sold it yesterday for $190k."

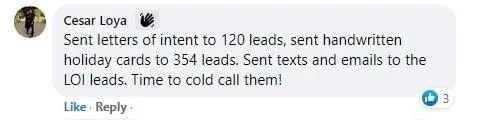

"Sent letters of intent to 120 leads, sent handwritten holiday cards to 354 leads. Sent texts and emails to LOI Leads."

"Got a flip up for sale and a new listing for my brother's flip"

"Got a $67k offer day 1... closing next Friday for a $30k profit after costs."

"Cash out refinanced my first 2 rentals and rolled it into the house across the street from me. Was able to get it off market under FMV."

"Just got my most current flip under contract for $30k over asking with $20k appraisal guarantee"

"Bought a note this week! 12% cash on cash and a 40% ROI!"

"Today alone sold our 12 unit, sold a SFR, and accepted offer on another 12 unit!"

"Selling to a local investor for $6500 profit."

"Closed on 15k wholesale deal. Put single family on MLS."

"Closed out my two flips."

"Closed on a short sale we have been working on since May"

"$68,500 purchase price, $20k rehab, $135k ARV. "

"Closed on a rental at $44K with $30K in equity."

"Finalized short sale negotiation this week & signing rehab loan documents today $200k equity"

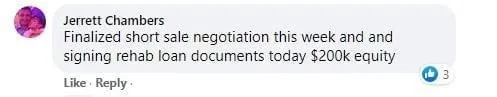

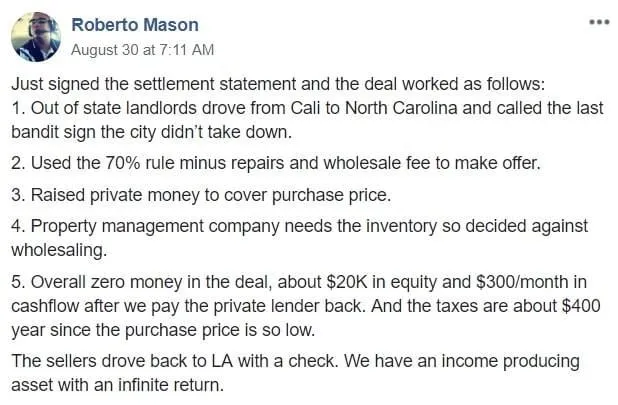

"PA signed on a seller finance deal with $30K in equity and $600/month cf."

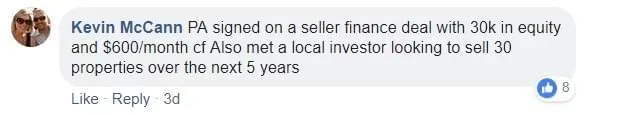

"We have an income-producing asset with an infinite return." ($300/mo)

"Pulled out $105K in equity."

"Assigned a deal for $22K."

"We went under contract on five different apartment buildings!"

"11 properties (land) under contract in last 3 weeks."

"Closing today on purchase of first rehab."

"I should be able to triple the market rent at this location."

"Appraised value = $230K, Total cost to acquire property = $1,600"